Contents:

Also, ask if you are eligible to receive a tax credit for paying timely state unemployment taxes. Employment taxes are reported using a Form W-2 for each employee, and Form 940 and Form 941 if you withhold any taxes from an employee’s paycheck. If you’ve ever balanced your checkbook, or simply compared the balances in your bank account and your company books to make sure they match, you’ve already performed a two-way reconciliation. In fact, some basic rules dictate how you must handle this money to ensure compliance. It’s also a great practice to record the details of each expense. For example, if you’re expensing a meal, you might record who you were with and what you discussed.

Accounting and financial management mistakes can threaten the well-being of any law firm. Fortunately, you can easily avoid many of them if you know which types of errors are the most common. Tens of millions of people have relied on FreshBooks, making it a solid choice for your firm. This comprehensive accounting tool can help you manage every aspect of your firm’s business, including expenses and revenues, client information, and communications.

Three-way Reconciliation

FreshBooks allows you to get paid faster by only visiting and entering financial information once, then will process the payments through our automated billing system. In fact, you’ll know exactly when your client has received and viewed your invoice. Keep your spending in check with FreshBooks accounting software. Get a detailed breakdown of where you’ve spent your money in any given time frame. FreshBooks accounting software makes remittances painless by always knowing the sales taxes you’ve paid and collected in any period. Simply enter your expenses and FreshBooks accounting software will digitally store and automatically organize them for you.

Start by making a list of your mandatory expenses, such as license fees, rent, and utilities. Then, set realistic personal and business goals, such as how much time you want to take off for vacation and whether you want to hire employees or contractors. After projecting your revenue, you can take a realistic look at what you need to do to achieve your goals.

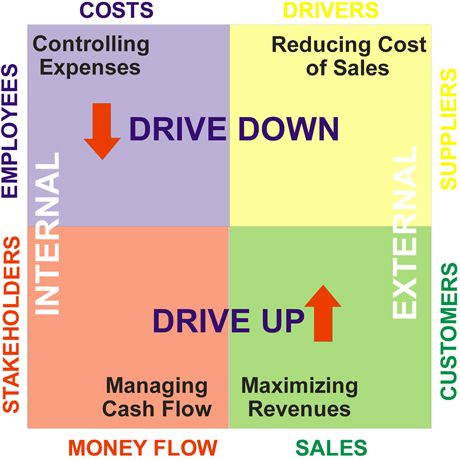

Financial KPIs Allow You to Monitor and Readjust

Here at Gurian PLLC, a CPA firm, we have developed a niche in tax and accounting services for law firms. Our customized, unique formula for the legal industry has been tried and tested to show success. Working with us will free you from the tedious accounting and bookkeeping tasks that are straining your time and resources.

This system sorts all https://1investing.in/ into two categories, assets and liabilities. All transactions are then recorded in a ledger, which is a record of all financial transactions. As an attorney, you’ll spend a lot of your time invoicing your clients. Picking an invoicing solution that automates the legwork can save you time and money.

Friday Footnotes: An Outsourcing Shortage Now Too?; Finally, Some Disruption; PwC Haters Celebrate Government Inquiry 3.17.23 – Going Concern

Friday Footnotes: An Outsourcing Shortage Now Too?; Finally, Some Disruption; PwC Haters Celebrate Government Inquiry 3.17.23.

Posted: Fri, 17 Mar 2023 07:00:00 GMT [source]

Two core tasks of a legal bookkeeper include data entry and bank reconciliation. Even if you master the basic principles of legal accounting, you’re still not an accountant or bookkeeper at the end of the day. To do this, legal accountants capture expenses, provide financial forecasting, and prepare financial statements.

Start by Hiring a Bookkeeper

This makes it much easier for your accountant to prepare financial statements and tax returns. For example, if a business owner is not keeping accurate records of expenses, they may be overpaying taxes or missing out on deductions that could save the business money. Furthermore, failing to track inventory levels can lead to stock-outs and lost sales, while not keeping tabs on accounts receivable could result in late payments and bad debt. The Trump tax reform eliminated or decreased transportation fringe benefits and client entertainment deductions previously available to law firms. It is important for lawyers to keep track of all related costs throughout the year in order to take advantage of these tax deductions. The double-entry accounting system is the most effective way to do bookkeeping for a law firm.

By having a CPA on board, law firms can get assistance with filing taxes and making sure they are compliant with all regulations. This can make the process smoother for new small businesses that may not be familiar with all of the tax requirements. Ultimately, by having an effective bookkeeping system in place, law firms can better manage their finances and create more opportunities for growth.

There are many benefits to double-entry accounting, but the main one is that it provides an accurate record of all financial transactions. This system can be used by any size business, but it is particularly beneficial for law firms because it helps them to keep track of their expenses and income. Law firms should avoid the accrual method of accounting because cash accounting is simpler and less expensive to administer. If law firms used a pure cash accounting system, their financial statements would be relatively straightforward and the tax liability would be easier to determine. Trust accounting is a required aspect of accounting for law firms.

Keeping all of your business expenses in your business account makes it way easier for your accountant to sort through transactions come tax season. When you have a trust account, you’re required to perform a three-way trust reconciliation every 30 to 90 days. Law school doesn’t teach lawyers anything about accounting, including how to manage their IOLTA. Many attorneys aren’t familiar with the rules governing these accounts and will unknowingly break these rules. It’s easier to start your legal accounting strong than to fix sloppy accounting done in the past.

Financial Manager Sentenced to 21 Months Imprisonment for … – Department of Justice

Financial Manager Sentenced to 21 Months Imprisonment for ….

Posted: Thu, 16 Mar 2023 07:00:00 GMT [source]

Practice Alchemyʼs approach to law firm bookkeeping includes a thorough understanding of your practice and the management of your books with a solution that works specifically for your firm. At The Legal Accountant, we go beyond just bookkeeping for law firms. We provide additional reporting and analysis so that you understand your numbers and how they impact your firm and your goals! We’re here to help you go beyond compliance and start achieving your financial goals, whatever they may be. We’ll take care of your finances for you so you can do the job you were meant to do – growing your firm and ensuring client success. Critical legal thinking takes a distraction-free environment, and we’ll give that to you.

6 Top Tax Deductions for Lawyers and Law Firms

It’s similar to two-way reconciliation, where you compare your bank account balance to your company’s books to make sure it matches. Instead, employ good accounting and budgeting practices, so you don’t need to dip into these fees in the first place. If you’re confident that you can manage a business credit card properly , it’s an excellent tool to grow your business. If your data isn’t kept up to date, then your legal accountant won’t be able to do their job as effectively. Use software like Uptime Practice to track billable hours, expenditures, and to keep your financial records in check. Your COA will look different depending on your jurisdiction, law firm’s size, and practice area, but will always have these categories.

- FreshBooks invoicing for attorneys also allows you to create professional looking invoices that are expected from those in the legal profession.

- If you commingle your personal and business funds, you’re “piercing the veil,” and courts will ignore the legal protection that comes with incorporating.

- With our dedicated and experienced bookkeepers, you potentially transform the financial management of your law firm.

- Many lawyers go to one or the other extreme—they either claim everything (and possibly more than they’re allowed to), or they’re so afraid to overstep they miss out on tax deductions.

- Legal accounting and attorney bookkeeping mistakes have catastrophic consequences for your business, income taxes, and license.

- The cash method better matches taxable income with cash received and makes it easier to pay the tax liability.

If accounting for lawyers seems intimidating, a robust knowledge of the basics can help every practice avoid common mistakes. Familiarize yourself with the generally accepted accounting principles for financial statements that are complete and comparable. Then, review your general ledger to better understand your law firm’s financial transactions. Once you’re geared with this information, refresh your knowledge on how to read the critical financial statements for your practice, like the income and cash flow statements and balance sheets.

Accounting Software For Finance & Legal

Trust accounting causes a lot of problems for lawyers, so, in general, you’re going to need to follow a couple of steps to ensure compliance with IOLTA rules. We recommend you hire a legal bookkeeper and accountant to help keep you and your firm on track. Here are five common law firm accounting obstacles and mistakes you should be aware of so you can avoid them. If you own a business, you need to get good at recordkeeping.

With an all-contained law firm bookkeeping and accounting system, users can enjoy having all their financial data in one place—reducing the risk of critical errors. In most cases, law practice management software doesn’t include an accounting element specialized for law firms. This leaves you with the purchase of additional non-legal accounting software.

- The benefit of this approach is that you have a more realistic understanding of your law firm’s income and expenses.

- An accountant who has experience with financial forecasting and strategy can help a law firm plan for its future expenses and income.

- Access your account from your desktop, laptop, tablet or phone.

- You’ll know at a glance what you’re spending and how profitable you are, without the headache of spreadsheets or shoeboxes.

- While this primarily applies to new law firms, ensuring that the basics are determined and set up correctly is critical.

That’s why incremental cost accounting necessitates you track accounts receivable and accounts payable on your balance sheet. It’s not as dire as comingling your business and trust accounts, but it’s a slippery slope toward unorganized accounting. Every lawyer that manages trust accounts should know what three-way reconciliation means. A fundamental concept in accounting and bookkeeping, double-entry accounting states that all financial transactions have equal and opposite effects in two different accounts.

Cloud-based accounting software for law firms also automatically gets updated and backed up, offering unparalleled, real-time insights into your firm’s financial data. For successful law firms, maintaining accurate and up-to-date bookkeeping records is essential. Whether it is handled in-house or outsourced to a professional, bookkeeping can help reduce the cost of operations. It’s important for law firms to maintain a consistent schedule when it comes to bookkeeping activities in order to ensure accuracy in their accounting records. Additionally, an accountant or bookkeeper can provide valuable advice and tips on how best to manage the books for a law firm.

With these tips, you can ensure that your law firm’s bookkeeping is effective and efficient. By keeping up with your records and hiring a professional, you can avoid any potential problems and keep your finances in order. Lawyers are required by law to maintain separate trust accounts for their client’s funds. They are not allowed to commingle these funds with their own money or use them for any purpose other than holding them in trust for their clients.

We will support your firm with a team of talented and experienced accountants. You won’t have any trouble finding us, and you’ll always have access to your critical financial information. Our team will join your team, and we’ll work tirelessly for your success in the same way you do.